MICHIGAN NEWS

GONE FISHING -- FOR

YOUR WALLET:

Michigan Senate budget hooks boater, anglers, drivers

Higher fees would feed budget that has ballooned by 47% over 6 years

By Scott McClallen, May 28, 2025

Michiganders will pay higher fees

for vehicle registration, boating, and fishing if the state enacts the $84.6

billion budget for fiscal year 2026 that was recently passed by the Michigan

Senate.

Michiganders will pay higher fees

for vehicle registration, boating, and fishing if the state enacts the $84.6

billion budget for fiscal year 2026 that was recently passed by the Michigan

Senate.

The recommendation exceeds Gov. Gretchen Whitmer’s budget by more than a billion

dollars but still requires the approval of the Michigan House.

The fee increase comes after a six-year period during which Michigan’s budget

has grown by 47%.

Lawmakers want to require every Michigander who registers a vehicle to pay an

extra $10 for a recreational park pass, a purchase that has been optional to

date.

Michigan aims to raise $43.5 million in revenue through the higher recreational

fee. The higher hunting and fishing fees are intended to raise $28.8 million,

and the higher boating fee aims to bring in $12 million. The new Department of

Natural Resources budget would hire 29 new full-time employees.

The budget will help Michiganders, said Sen. Sarah Anthony, D-Lansing, who leads

the Senate Appropriations Committee.

“Our budget puts Michigan families first — plain and simple. It’s a reflection

of what we’ve heard from residents across the state: They want good schools,

safe communities, access to health care, and real opportunities to build a

better life,” Anthony said in a press release. “From securing more resources in

the classroom to upskilling workers and strengthening our local economies, this

budget is about delivering results, not rhetoric.”

The Senate budget would increase the state’s foundation allowance to $10,008 per

student. It would also commit $350 million toward student mental health and

school safety.

The Senate budget has now moved to the House for further consideration.

Republicans panned the budget enacted by the majority Democrats. It includes

unnecessary spending, including a $1 million fund that could enable those with

previous marijuana convictions to enter the marijuana business, said Sen. John

Damoose, R-Harbor Springs.

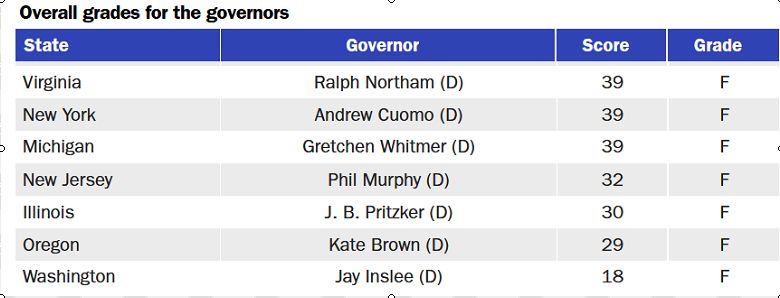

Michiganders spend more money, but they get worse services, according to a

statement from Sen. Thomas Albert, R-Lowell.

“State budgets for education also fail Michigan taxpayers,” Albert said. “Gov.

Gretchen Whitmer noted in her State of the State address that Michigan invests

more per pupil in K-12 education than most states but remains in the bottom 10

for student achievement. Yet the Senate’s proposal does not even include the

governor’s call for more tutoring and intervention in low-performing districts,

along with corresponding accountability measures.”

Albert criticized the budget for “spending more money without ensuring it leads

to better outcomes for students, and that doesn’t make sense.”

The Senate and House must approve a plan before sending it to the governor for

review and approval.

Sen. Joseph Bellino, R-Monroe, cited recent trends while making a statement

opposing the budget.

“Our state budget has ballooned by more than 40% since Gov. Whitmer took office

just six years ago — yet this reckless budget plan continues to increase

spending,” Bellino said. “I cannot support an unbalanced spending plan that

fails to fix the roads, fails to provide relief to struggling families, fails to

improve student academic performance and fails to live within our means — all

while once again calling on Michigan taxpayers to pay more.”

Michigan Capitol Confidential is the news source produced by the Mackinac

Center for Public Policy. Michigan Capitol Confidential reports with a

free-market news perspective.

OWOSSO BARBER

STILL BATTLING $9K IN FINES FROM WHITMER LOCKDOWN

77-year-old was one of six hairdressers state

fined for cutting hair in 2020

By Jamie A. Hope, April 28, 2025

Sarah

Huff, who owns a salon in Holland, cuts hair at Operation Haircut near the steps

of the Lansing Capitol on May 20, 2020, when Whitmer banned haircuts | Rodriguez

Photo Company

Sarah

Huff, who owns a salon in Holland, cuts hair at Operation Haircut near the steps

of the Lansing Capitol on May 20, 2020, when Whitmer banned haircuts | Rodriguez

Photo Company

Michigan residents and small business owners targeted by the Whitmer

administration got a long-delayed chance to speak on April 23 as the

Republican-controlled state House held its first hearings on government

overreach during the COVID lockdowns.

Two business owners and a lawyer described how they were targeted by Attorney

General Dana Nessel, the Whitmer administration, and local government at the

House's Weaponization of State Government hearing.

Gov. Whitmer declared barbers and hairdressers “nonessential” in 2020. Six

barbers and hairdressers defied the lockdown orders and were criminally charged

for cutting hair at the Michigan Capitol on May 20, 2020.

Five years later, Karl Manke, an Owosso barber, is awaiting a ruling in the

Shiawassee County Circuit Court to drop the fines, he said in the subcommittee

hearing. During the lockdown period, state government entities temporarily

suspended his barbershop and occupational license when he reopened his shop,

according to Kallman Legal.

The 77-year-old racked up $9,000 in fines, but Manke kept working to pay bills.

He believed Whitmer’s executive orders violated his rights, and the Michigan

Supreme Court ultimately agreed in October 2020.

Manke's fines included $1,500 for having hair and neck strips on his barbershop

floor and having a comb in his pocket during a televised media interview. He was

also fined $6,000 for cutting hair without a license on the steps of the

Michigan Capitol during Operation Haircut, a protest of Whitmer’s orders in May

2020. Though his license was later reinstated, the state refused to drop the

fines.

When the Michigan Supreme Court ruled in September 2020 that Whitmer’s orders

were unconstitutional, the charges against Manke were dropped.

Manke told the subcommittee he was never notified about the loss of his license.

Rep. Angela Rigas, R-Alto, chair of the Weaponization of State Government

subcommittee and a hairstylist for 25 years, said the $1,500 fine for having a

comb in a pocket was unusual.

Subcommittee member Laurie Pohutsky, D-Livonia, compared Manke to Michiganders

who are still in prison for marijuana violations that occurred before cannabis

became legal in Michigan.

Whitmer tapped emergency orders through the state health department after

reaching the limit of her executive-order powers.

Holland restaurant owner Marlena Pavlos-Hackney testified about Attorney General

Dana Nessel's determined effort to arrest her before she could appear on Tucker

Carlson's Fox News show to speak about reopening her business against pandemic

orders.

Emails obtained by Michigan Capitol Confidential in 2021 revealed that Nessel

explicitly stated her desire to have Hackney arrested before she could go on

Carlson's show. Hackney's testimony and present situation will be covered more

fully in an upcoming CapCon story.

Michigan Capitol Confidential is the news source produced by the Mackinac

Center for Public Policy. Michigan Capitol Confidential reports with a

free-market news perspective.

MICHIGAN REGULATORS

ORDER FAMILY FISHING SPOT FILLED

Lawmaker calls for funding cuts over pond

dispute

By Scott McClallen | March 27, 2025

A

Michigan lawmaker wants to cut a state agency’s funding over disputes with

residents.

A

Michigan lawmaker wants to cut a state agency’s funding over disputes with

residents.

The new oversight committee fielded many complaints about the Michigan

Department of Environment, Great Lakes, and Energy, said Antrim Township

Republican Rep. Brian BeGole in a March 22 social media post.

“EGLE needs a lot of change and I have a feeling big budget cuts are coming for

them,” BeGole wrote.

The environmental agency is trying to force one Freeland man to fill in a pond

on his private property, Michigan Capitol Confidential reported in January. Two

months later, his brother Zach Wenzlick shared his story with Michigan lawmakers

via the House Oversight Committee on March 18. The state could fine Joshua up to

$1.7 million for expanding his pond from 2020-2023.

Joshua hired Schlicht Ponds of Montrose, a licensed contractor, to excavate the

pond to about 20 feet in one section. That depth is sufficient to sustain

wildlife when the pond freezes over in the winter, ensuring there is enough

oxygen.

Joshua stocked the pond with about 700 fish — a mix of bass, bluegill, crappie,

and perch. After stocking the pond, ducks, geese, and painted turtles moved into

the pond, Zach said.

But in March 2023, someone submitted an anonymous complaint about the property.

State employees visited the property without notice, Zach said.

Zach said Joshua gave the environmental agency a previous ruling that the pond

was a non-regulated wetland.

In June 2023, Joshua received a letter of a possible violation. The agency

referred the case to Michigan Attorney General Dana Nessel for enforcement, Zach

said.

In January 2024, Joshua received an order demanding that he restore most of the

one-acre pond to 18 inches or less of water, Zach told lawmakers.

That would kill all fish in the pond when it freezes during winter.

The environmental agency says it lawfully investigated an alleged violation of

Section 30314 of the Wetland Protection Act, as well as Part 301 Inland Lakes

and Streams, of the Natural Resources and Environmental Protection Act. The

agency is allowed, officials said, to enter premises suspected of causing an

“imminent threat to the public health or environment” or if it has reasonable

cause that the wetland “is a water of the United States as that term is used in

... the federal water pollution control act.”

The family flipped vacant mining land into a pond where they fish and enjoy

nature, Zach said.

“This is where we spend every 4th of July celebrating,” Zach said. “Where I wake

up on Saturday mornings with my son and we go fishing with my brother.”

“All my brother has done is take previous mining wasteland and turn it into a

thriving ecosystem,” Zach said.

The environmental agency hasn’t responded to a request for comment. Previously,

it denied any wrongdoing.

The family has been caught in a nightmare for over a year and treated like

criminals over a pond, Republican Rep. Matthew Bierlein of Vassar, said in a

March 18 social media post.

“My office has stood with Zach and his family since last year as they face a

situation no Michigander should ever have to endure,” Bierlein said. “This isn’t

just about a pond. It’s about property rights, government accountability, and

ensuring that no hardworking family is forced to defend themselves against this

kind of overreach.”

Michigan Capitol Confidential is the news source produced by the Mackinac

Center for Public Policy. Michigan Capitol Confidential reports with a

free-market news perspective.

MICHIGAN ELECTRIC

VEHICLE MAKER TO CLOSE TWO LOCATIONS AFTER POCKETING $900,000 SUBSIDY

Company

returning production to South Carolina

By Scott McClallen, February 24, 2025

Receiving

$900,000 of taxpayer money won’t stop a Michigan electric vehicle maker from

shuttering two locations and taking 188 jobs out of state.

Receiving

$900,000 of taxpayer money won’t stop a Michigan electric vehicle maker from

shuttering two locations and taking 188 jobs out of state.

Auburn Hills-based automotive supplier BorgWarner will close two plants of its

subsidiary Akasol Inc., in Hazel Park and Warren. Layoffs will run from April 14

through July, according to a notice issued to the state under the federal WARN

Act.

The factories test products for electric vehicles, including battery modules and

packs, direct current fast charging equipment, and microgrid control and

operations, according to a 2023 news release.

In 2019, the Michigan Strategic Fund awarded the company $2.24 million in

taxpayer money for its Hazel Park plant, with the expectation it would create

224 jobs. The money would be paid out over five years as the company met

milestones for creating jobs.

But the state and the company amended the deal in 2022. Instead of being

promised $2.4 million over five years, the company received $900,000, according

to a Michigan Strategic Fund annual report. The company created 66 jobs,

according to the MSF report.

BorgWarner will close the plants as it pursues growth, the company told Michigan

Capitol Confidential.

“Consistent with those efforts, we have decided to shift all battery production

from our Hazel Park and Warren, Michigan, locations to our existing plant in

Seneca, South Carolina,” the company said in an email. “We believe in our

battery product portfolio and the opportunity for continued growth as customers

increasingly require innovative eMobility solutions."

Michigan officials have given various companies billions in taxpayer money in

return for jobs, but over a two-decade period, only one of every 11 jobs

promised actually got created, according to a new study by the Mackinac Center

for Public Policy. The study reviewed front-page news stories about government

grants to private businesses from 2000 to 2020, revealing that these deals

rarely meet job-creation goals.

When job deals made by the Michigan Economic Development Corporation fail, the

agency redefines success and declares victory, John Mozena, president of the

Center for Economic Accountability, told CapCon in an email.

“The MEDC is supposed to be guarding the interests of Michigan’s taxpayers and

holding companies accountable, but they act like their real allegiance is to the

companies that are getting the free money,” Mozena wrote. “That’s not

surprising, given that the MEDC’s board is made up of people who benefit from

these deals rather than anyone who might be a skeptic or whistleblower.”

Michigan can’t subsidize the auto industry to prosperity, according to Mozena.

“Whether it’s traditional cars and trucks, electric vehicles, so-called

‘mobility’ or whatever’s next, Michigan needs to tell the industry to stand on

its own feet, pay for its own factories and stop expecting Michigan’s taxpayers

to artificially inflate their balance sheets,” he wrote.

In 2023, Michigan lawmakers gave select private companies $4.6 billion in

subsidies.

“This deal is another reason lawmakers, taxpayers and voters should exercise

skepticism about corporate handouts,” Michael LaFaive, the Mackinac Center’s

senior director of fiscal policy, told CapCon in an email.

“State government confiscates taxpayer money to subsidize a company it thinks is

a real winner,” LaFaive wrote. “Then it issues a celebratory and

self-aggrandizing press release announcing alleged jobs that will be created.

The announcement is dutifully reported if not cheered in the press, only to see

that big corporate winner become a big loser in the marketplace.”

The company received a $900,000 MBDP grant. It was originally for $2.4 million,

however, through an amendment approved by the Michigan Strategic Fund Board, it

was reduced to $900,000, according to Otie McKinley, the media and

communications manager of the MEDC.

Michigan Capitol Confidential is the news source produced by the Mackinac

Center for Public Policy. Michigan Capitol Confidential reports with a

free-market news perspective.

SELECTIVE

SUBSIDIES ARE A LOSING STRATEGY FOR MICHIGAN

Corporate welfare does not fuel high-growth

states, and is not the answer for Michigan

By James M. Hohman, November 28, 2023

Politicians

are eager to take credit when companies like Ford Motor Company announce an

expansion that’s funded by taxpayer money. (Ford Motor Company press conference

announcing BlueOval Battery Park)

Politicians

are eager to take credit when companies like Ford Motor Company announce an

expansion that’s funded by taxpayer money. (Ford Motor Company press conference

announcing BlueOval Battery Park)

Michigan is falling behind. Jobs nationwide are up 3.0% from pre-pandemic

levels; Michigan has yet to recover all the jobs it lost in the pandemic. Its

0.7% decline is seventh-worst among states. The response from lawmakers was to

spend billions on selective business subsidies. It won’t work.

The states that have been growing the most are not the ones writing the biggest

checks to the biggest companies. They are Idaho and Utah, the states that spend

the least on selective business subsidies.

Handing out favors is no way to get ahead. The states leading the pack do the

least of it.

In contrast, Utah and Idaho score highly on what matters: economic freedom. The

Fraser Institute measures and ranks states based on their economic freedom, and

it puts the two states in the top 10.

Utah and Idaho protect property rights, only have regulations where they protect

the public, and keep taxes low. The formula works.

It works because basic rules affect everyone, while favoritism is only granted

to the few.

Most job creation happens without politicians getting involved. Michigan

businesses added 214,600 jobs in the first three months of 2023 and lost 187,400

jobs over that period. Businesses created one job for every 18 that were in the

state and lost one out of every 20 jobs.

The state’s economic development agency issued press releases that it had

awarded 18 businesses $293 million in taxpayer money to create 4,200 jobs during

the same period.

Job announcements are not the same thing as jobs — Ford Motor Co. already said

it’s scaling back a project that was part of the state’s releases — and the

state’s record of turning announcements into employment is pretty bad.

Still, even if things went according to plan, administrators would not be able

to replace 2% of the jobs lost in the economy.

Michigan is a leader in handing out special deals, but not at the scope

necessary to make a dent in the state’s job picture. Economic fundamentals

matter, as demonstrated in the states growing the most.

Favors exist because politicians love job announcements. It makes it seem like

they are doing something to create jobs.

Gov. Gretchen Whitmer adds a quote to all the press releases.

“Michigan is on the move, and we have an extraordinary opportunity right now to

create thousands of good-paying manufacturing jobs and bring supply chains

home,” Whitmer said in one.

It makes it sound like handing out money to companies will help grow the

economy.

But there is a difference between appearance and performance. In the ways that

matter, Michigan continues to fall behind.

Corporate welfare has three basic problems.

First, it’s an ineffective way to create jobs. Second, it’s unfair to the

businesses that don’t get handouts. Third, it is expensive to taxpayers.

There are several possible reasons why selective favors are ineffective. Many

companies that get cash could have done the same thing without deals from the

state. And there are real costs to the handouts, money that could be put to

productive uses elsewhere.

Time and again, economists find that handing out favors is no way to drive the

economic growth that politicians say they deliver with their deals. Michigan

won’t be “on the move” because Whitmer hands out subsidies to the right

companies.

Businesses only ask for favors when they think they can get politicians to

approve them. They’re happy to play states off each other to get more from cash

and tax breaks.

Instead of offering hundreds of millions to the next big company that asks for

favors, lawmakers should be working across state borders to agree to stop

handing out favors. They can agree to an interstate compact to drop their

favoritism, and such things have been introduced in the past, and there is a

bill to do so in Michigan at present.

Michigan should trash its selective subsidy programs. It’s a huge expense for a

failing strategy.

James M. Hohman is director of fiscal policy at the Mackinac Center. Email

him at hohman@mackinac.org.

Michigan Capitol Confidential is the news source produced by the Mackinac Center

for Public Policy. Michigan Capitol Confidential reports with a free-market news

perspective.

SO YOU WANT TO

MOVE TO MICHIGAN? HERE'S THE REALITY

$20M marketing blitz won’t mask Michigan’s

problems, but an engaged public can help

By James David Dickson, October 15, 2023

“You Can in Michigan” attempts to mask reality with

marketing. (State of Michigan)

The state of Michigan is spending $20 million on a multiyear campaign, called

“You Can in Michigan.” Between the new campaign and Gov. Gretchen Whitmer’s

“Make It In Michigan” effort, the state is spending about $60 million to tell

Michigan’s story beyond its boundaries.

The sales pitch is simple: “Career opportunity, quality of life and

affordability.”

It’s a nice thought, but it solves the wrong problem. The reason people leave

Michigan, or do not move here, does not owe to bad marketing or to a lack of

marketing. It owes to reality.

Between the roads, the electrical grid, and the schools — all poor — quality of

life is a struggle in Michigan, not a reason to move here. Yes, it’s pretty. But

what else?

Michigan is run as a 150-person club out of Lansing, not as a state of 10

million people. Lawmakers spend $82 billion of the public’s money. A billion of

that is on earmarks, pure pork, with only vague details about where the money is

going, and at whose behest. Lawmakers frequently don’t have access to current

information on bills, and the information available to the public is often

months old.

If you want to move to Michigan and be an involved citizen, transparency is a

battle you will fight, from local governments to the state government in

Lansing.

We have a state government whose tentacles extend into every aspect of your

life, either overriding local decision-makers or removing them from the process.

Should your private school administer medical marijuana? Should a farmer be able

to put wind turbines and solar panels on their property? Under current

leadership, the belief is that those decisions should be made in Lansing, not

locally.

We have leaders for whom the saying “character is destiny” augurs poorly.

We have government officials who go to great lengths to cancel income tax cuts

for the public. They then turn around to offer billions in corporate welfare to

Michigan’s biggest companies. Our leaders believe the answer to every problem,

even a state-created problem, is more bureaucracy.

We have a governor and attorney general who used the power of the administrative

state to crush — or attempt to crush — barbers or restaurant owners who dared to

earn a living during a pandemic. Not every business owner made it. Some people

lost everything.

Come to Michigan, if Tim Allen’s voice urges you. And you will find a state that

needs help.

You will find children left behind by Zoom schooling. You will find workers left

behind by the government-driven transition to electric vehicles. You will find

good people stunned by the difference between the Michigan they grew up in and

the Michigan they now occupy.

They’ll never leave, and they’ll always believe. They’re just not sure what to

do next.

Come to Michigan. You can call it the Fresh Coast, even.

But when you do come, ask not what Michigan can do for you. Ask for a bucket,

and start bailing water.

James David Dickson is managing editor of Michigan Capitol Confidential.

Email him at dickson@mackinac.org.

Michigan Capitol Confidential is the news source produced by the Mackinac Center

for Public Policy. Michigan Capitol Confidential reports with a free-market news

perspective.

WHITMER (AGAIN)

TOUTS THOUSANDS OF JOBS THAT DON'T EXIST

Governor misrepresents job announcements as

jobs

By Jamie A. Hope, August 4, 2023 Share on FacebookShare on Twitter

Gov. Whitmer boasts of thousands of new jobs to

make batteries for electric vehicles. None of those jobs have appeared.

Gov. Gretchen Whitmer boasted in an Aug. 2 tweet that she has been successful in

luring investments in battery manufacturing plants, claiming the subsidized

plants will add thousands of jobs. But the record shows a different story.

“If you’re keeping score, when I took office, we had 0 battery manufacturing

facilities. Soon we will have 5,” Whitmer wrote. “We’ve brought home more than

$16 billion in projects and secured over 16,000 jobs building EVs, batteries,

semiconductors and clean energy.”

The job numbers Whitmer cites in her tweet are potential future jobs that have

been announced, not positions that are currently filled, available, or in the

process of being created. Such misleading and sometimes false claims have been a

hallmark of Whitmer’s administration.

Politicians often hype tax-paid subsidies to corporations by describing jobs

projected as jobs themselves. In nearly all cases, the number of new jobs ends

up being far smaller than the number announced.

State officials gave $100 million to Ford Motor Co. in 2022 and announced that

the company was going to create 3,000 new jobs. Ford announced two months later

that it was laying off 3,000 workers.

None of the plants noted in Whitmer’s tweet exist yet. There are not 16,000 jobs

secured.

Whitmer’s tweet casts a negative light on one of her predecessors’ own

outlandish job-creation claims. Michigan had 2,521 battery manufacturing jobs in

2022. This was up from 763 such jobs in 2011. Gov. Jennifer Granholm spent

hundreds of millions of dollars in public funds trying to establish battery

manufacturing through her green energy program. Yet there were no battery

manufacturing facilities in the state when Whitmer took office, raising the

question of what Michigan taxpayers got for their money last time.

Granholm also boasted that her administration’s subsidies would create thousands

of new jobs and make Michigan the world hub of battery manufacturing. That never

happened. Now Whitmer is making the same promise.

Whitmer’s office did not respond to a request for comment.

Michigan Capitol Confidential is the news source produced by the Mackinac

Center for Public Policy. Michigan Capitol Confidential reports with a

free-market news perspective.

'SCAFFOLDING FOR PLUNDER'

Michigan Government Runs Roughshod

By Michael D. LaFaive,

April 27, 2023

Looking back on the first quarter

of 2023 it is not hard to be reminded of James Coffield’s famous description of

the British income tax system as “Scaffolding for Plunder.” Yet in Michigan

recently it feels broader, as if it is the whole government system working to

plunder us, not just the tax system.

Looking back on the first quarter

of 2023 it is not hard to be reminded of James Coffield’s famous description of

the British income tax system as “Scaffolding for Plunder.” Yet in Michigan

recently it feels broader, as if it is the whole government system working to

plunder us, not just the tax system.

Regardless of the political party in charge, many of us know or sense that we’re

shouting “stop” into a void. Michigan’s elites and elitists in government and

business are together running roughshod over the very people they force to pay

government’s bills. The only fixes may be constitutional.

One good example of this involves corporate handouts. In the last three months

alone, Lansing politicians have appropriated a staggering $3 billion in direct

subsidies for a handful of corporations. Not only is this unfair — forcing all

of us to underwrite the private interests of a favored few — but it is

ineffective. The majority of independent scholarship shows such programs don’t

create the jobs promised or at least not in a cost-effective way.

They can, however, result in windfall profits for powerful corporations who

would have likely created jobs without incentives. Their political handmaidens

also do well, increasing the likelihood of favorable headlines, ground-breaking

photo-ops and, in some cases, reelection. These subsidies are political tools

wearing the mask of economic development policy.

Companies that make political contributions are four times as likely to receive

government subsidies than those that do not. The subsidies are on average 63%

larger. One determinant of a large increase in state corporate handouts is

whether a state’s governor is up for reelection. Cities who have elected mayors

lavish larger subsidies on corporations than cities without an elected head. The

list goes on.

Corporations, politicians and their lieutenants in state agencies have a

symbiotic relationship, and together they’ve grown Michigan’s parasite economy.

Who pays? The rest of us, with slower growth, higher tax bills than would

otherwise be necessary and opaque, if not misleading governments. This group

works hard to protect its turf.

Michigan’s economic development agency has repeatedly bought questionable

studies to puff up its purported efficacy. It also aggressively blocks or

ignores attempts to acquire information that might illuminate its failures. It

even keeps its offers of taxpayer cash secret by using non-disclosure

agreements. Transparency might otherwise open it up to damning criticism and

threaten elites’ financial and political gravy trains.

And this is just in one area where politicians unfairly award the favored few

with special favors. There are others. A bill was recently introduced that would

swap out union members’ dues for taxpayer money. It’s likely the unions would

use a percentage of it to engage in politicking. In other words, your dollars,

their politics.

Another new bill would permit the creation of “solar energy districts” and would

be approved locally. It would require votes by those who own 50% of the assessed

property value. That is, one or two large property owners could theoretically

vote to create a solar district and drag others along with them. The same bill

would immediately grant tax exemptions for the districts. In addition to playing

favorites, the bill will promote the construction of far more solar energy

across the state.

But solar is already a heavily subsidized, unreliable, and expensive energy

resource that is gobbling up valuable farmland, at the same time as it relies on

questionable labor practices and threatens a massive increase in environmental

impacts.

If it seems like the “policymaking process” has been captured in a way “that

serves the well-off at the expense of the general welfare,” then join the club.

In their book, “The Captured Economy: How the Powerful Enrich Themselves, Slow

Down Growth, and Increase Inequality,” authors Steven Teles and Brink Lindsey

argue that it is government that is pushing markets and income equality in “an

inegalitarian direction.” Upward, that is.

What is the solution? There’s no panacea, but the authors recommend

constitutional prohibitions on the power of lawmakers. These could include a

Sustainable Michigan Budget amendment or a prohibition against granting fiscal

and other favors to specific corporations or industry.

Michigan state government suffers from too much favor seeking and granting. The

alliances between corporate and political classes result in harmful and

expensive policies. If thwarting those takes changes to our constitution then so

be it.

Permission to reprint this blog post in whole or in part is hereby granted,

provided that the author (or authors) and the Mackinac Center for Public Policy

are properly cited.

MICHIGAN TEACHERS UNION MAKES

FAKE CLAIM OF ATTACKS BY PARENTS

Seeking to silence school board opponents,

Michigan Education Association joins national effort to demonize dissent

By Jamie A. Hope | October 13, 2022

The Michigan

Education Association attacks parents in an article on the union’s website,

calling for a campaign against a “loud minority of extremists” who dissent from

official policies during school board meetings.

The Michigan

Education Association attacks parents in an article on the union’s website,

calling for a campaign against a “loud minority of extremists” who dissent from

official policies during school board meetings.

“Parents, education advocates and several candidates for office came together

during a break in the monthly State Board of Education meeting on Tuesday to

speak out against organized right-wing attacks that are attempting to divide

parents and educators,” according to the Sept. 14 article at MEA.org.

The article makes no effort to substantiate its claims of “organized right-wing

attacks” — beyond a reference to public comment periods having been “flooded” by

input from groups such as Moms for Liberty. That particular 501(c)(4) group was

founded in 2021 by former school board members in Florida, and it has grown to

nearly 100,000 members. The MEA applauds union members who vow to “push back”

against the “vocal minority.”

The teacher union’s attack on parents follows massive failures in Michigan’s

public education system. Michigan students’ proficiency in English and math fell

32% and 36%, respectively, between 2018-19 and 2020-21, according to MI School

Data, and scores have only partly improved since the end of COVID restrictions.

Michigan ranks near the bottom of U.S. News & World Report’s current ranking of

states for education — in 38th place.

Dissenting opinions at school board meetings have become government and union

targets since 2020, when COVID-related restrictions and new school curricula

prompted many formerly quiet parents to begin speaking up. They started voicing

concerns about what they call racially divisive and hyper-sexualized content

that their children are exposed to at school.

Holt Public Schools called for affinity spaces where white students are not

allowed. Saline Area Schools provide graphic sexual images in its curriculum.

The Rochester Community Schools District uses ‘White Fragility’ by Robin

DiAngelo in its teacher training materials. “All white people are invested in

and collude with racism” DiAngelo writes, “socialized into a deeply internalized

sense of superiority that we either are unaware of or can never admit to

ourselves, we become highly fragile in conversations about race.”

Teacher unions in the United States are no stranger to partisan politics; they

gave $6.7 million to Democrats in 2020 and $147,600 to Republicans, according to

OpenSecrets.org. The MEA is endorsing and financially contributing to numerous

candidates for local school boards this year.

Kim Laforet, a candidate for the Grand Ledge Public Schools Board of Education,

is not one of those individuals.

“Labeling parents and some educators as ‘right-wing extremists’ for merely

having a different view of how and what to teach our children is the problem we

are facing,” Leforet told Michigan Capitol Confidential. “Teaching about the

failings of our country, along with its successes, is imperative so that our

children learn not to make the same mistakes when they are the ones governing

our country. However, if they don’t have a love for our country, what can we

expect in our future? A country that bans free speech?”

Laforet says that schools in the country are sexualizing children and dividing

them based on race. She hopes that school boards will listen to parents when

they voice concerns that children who can hardly read now have access to books

with graphic depictions of sexual acts.

She notes that the MEA has lost thousands of members in recent years, saying

this is because the union does not represent all teachers, despite it claims.

She wants the educational system to be a place where differences co-exist,

“everyone has a voice” and all are treated with respect.

The MEA did not respond to a request for comment.

Permission to

reprint in whole or in part is hereby granted, provided that the Mackinac Center

and the author are properly cited.

MICHIGAN DOESN'T NEED

ITS OWN COLLEGE ROI CALCULATOR

Cheaper tuition,

not bigger promises, would help bring students back

By Jennifer Majorana, May

17, 2022

State governments are taking what

seems to be a practical step toward understanding the actual value of a college

education: websites that purport to quantify the worth of a diploma in dollars

and cents. But Michigan shouldn’t feel the need to follow suit.

State governments are taking what

seems to be a practical step toward understanding the actual value of a college

education: websites that purport to quantify the worth of a diploma in dollars

and cents. But Michigan shouldn’t feel the need to follow suit.

Higher education is in a bizarre place right now. Breakneck shifts to virtual

instruction in 2020, combined with rules about quarantining, social distancing,

testing, vaccinations and masking, have shifted the focus of higher education.

Even while responses to the pandemic have made the college experience less

engaging, policymakers have ramped up incentives for young people to attend

college with new programs, extra funding from the federal government and an

ongoing moratorium on required student loan payments. The result is a confusing

set of contradictions.

Fewer Michigan high school graduates are interested in attending college than

before COVID-19, despite the prodding of state and national officials.

Recruitment officers are having an especially tough time due to a long-term

trend of increasing college costs and a surge in inflation over the past year.

In response, school and state officials have developed return-on-investment

calculators to encourage more students to attend. Many states have started

websites that compare the expected salaries of new university graduates at

different institutions or majors.

Florida recently unveiled a website to help prospective college students and

parents to compare salary, employment prospects and the average loan burden at

Florida’s twelve public four-year institutions, broken out by field of study.

A variety of government, institutional, financial and informational websites

feature similar tools.

Choosing where and when to go to college, what to study and how much debt to

incur does matter for future success. But there are other factors to consider.

A degree doesn’t come with a salary guarantee. Many college graduates end up

working outside their fields. It should be no surprise: What you thought you

would do at age 18 or 22 doesn’t predict what you will do when you are 40 or 44.

Furthermore, the well-paying jobs of today might not exist in the future. And

the well-paying jobs of the future might not exist today.

The tools are not entirely valueless. Prospective students may want to see how

well-off graduates are, and compare the salaries earned by graduates from

different degree programs in different schools. College return-on-investment

calculators can help students make more informed decisions about their future

prospects for repaying education loans.

Should Michigan follow Florida’s lead in creating yet another college

return-on-investment calculator, specific to Michigan public universities?

Probably not. Lawmakers can insist colleges not mislead students, and high

school guidance counselors can incorporate existing calculators into their

advising process. But Michigan doesn’t need its own calculator. They’re already

widely available.

Instead of encouraging students to fixate on simplistic returns from degrees,

lawmakers should encourage schools to lower costs. The price tag of

postsecondary education is headed in the wrong direction, and higher government

spending tends to exacerbate the problem. An overpriced investment naturally

leads to lower returns for anyone, regardless of which college or major one

chooses.

Flooding the decision-making process with more calculators won’t increase the

return on investment that students make. Finding ways to reduce the cost of

college will.

Permission to reprint this blog post in whole or in part is hereby granted,

provided that the author (or authors) and the Mackinac Center for Public Policy

are properly cited.

GOVERNOR'S BUDGET

DOWNGRADES CHARTER SCHOOLS

Whitmer’s school

aid proposal picks winners and losers

By Ben DeGrow, February 15,

2022

Michigan’s governor wants another

major infusion of extra tax dollars into the state’s public schools. The

predictable approach has been rewarded with approving media headlines. But one

troubling aspect of her proposed spending has received little attention: the

extent to which it picks winners and losers.

Michigan’s governor wants another

major infusion of extra tax dollars into the state’s public schools. The

predictable approach has been rewarded with approving media headlines. But one

troubling aspect of her proposed spending has received little attention: the

extent to which it picks winners and losers.

Gov. Gretchen Whitmer’s new school aid budget comes in two parts. First, she

wants nearly $2 billion more to spend between now and September 30, primarily on

programs designed to fill classrooms. That includes money to defray college

tuition costs for prospective teachers, pay stipends to student teachers and

provide the first round of multi-year four-figure bonuses for instructors to

stay on the job.

Second, Whitmer put forward a 2023 proposal that would spend 8% more than this

year’s approved amount. Excluding federal funds, it would be the largest school

aid budget increase of the century. The $18.4 billion executive school aid

budget, made up of both state and federal funds, would continue a clear trend of

K-12 spending growth. It includes everything from a 5% per-pupil formula boost

to more state dollars for facilities, preschool and student mental health.

There’s a worthwhile discussion to be had about broad budget strokes and overall

price tags. But her request should not stand as introduced, because it

discriminates against certain educators, schools and students without sound

reasons.

Whitmer wants to provide a $2,000 retention bonus to teachers across the state,

but only to those who are directly “employed by” their districts. Most public

charter school teachers are paid as contractors and thus wouldn’t be eligible

for the bonus. But there’s no evidence that these schools are less affected by

staffing challenges. Nor are there data to support fears of a mass teacher

exodus generally.

Next, the governor’s 2023 budget calls for adding “$170 million annually over

the next 6 years” to a state fund intended to help local schools pay for

building and infrastructure projects. School buildings that are leased, rather

than owned, would not qualify for the financial aid. That excludes many charter

schools, which unlike conventional districts, lack the authority to raise local

taxes to help finance facility additions or upgrades.

Finally, Whitmer explicitly seeks to leave out students who select an online

charter school from the promised primary funding increase. Her budget would

raise base per-pupil funding from $8,700 to $9,135, but not for students

enrolled in online charter schools. This gratuitous decision would save just a

tiny portion of the overall budget – estimated between $5.7 and $7.7 million

based on recent enrollments – on the backs of select students. If she believes

that money is too much, it could come out of another part of the school aid

budget.

On the other hand, one could look at this last proposal as progress. The last

time Whitmer targeted students to deny them an across-the-board funding

increase, it affected students in all charter schools, or about 10% of the

state’s public school enrollment. And in 2021, she called for a 20% cut to cyber

school formula funding, even as these schools accepted a surge of incoming

students.

It’s difficult to take the governor’s budget proposals seriously when they treat

charter schools and their students as second-class citizens. The attempts to

placate interest groups at the expense of these students belies the praise of

state superintendent Michael Rice, who declared that Whitmer’s budget “puts

students first.”

Rice’s cheery rhetoric about “students” unfortunately leaves out many students

whose families have chosen different public education options. Time and again,

the governor has denied parents any say over education funds. Now, while

doubling down on attempts to enrich the system, her budget proposal is treating

some families’ choices as second-class.

To truly put children first, the Legislature should reject the Governor’s

preferential treatment of some students and pursue a different path.

Permission to reprint this blog post in whole or in part is hereby granted,

provided that the author (or authors) and the Mackinac Center for Public Policy

are properly cited.

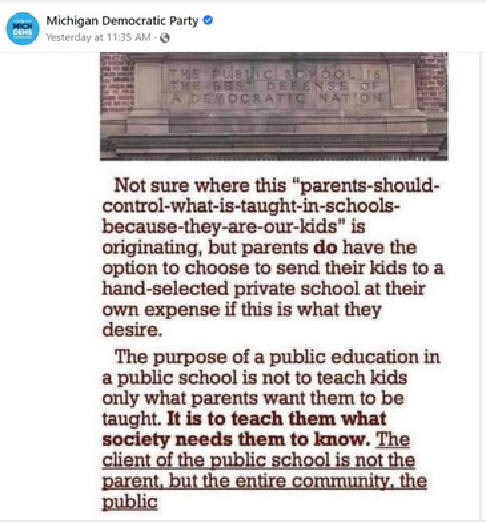

MICHIGAN DEMOCRATIC PARTY:

'THE CLIENT OF THE PUBLIC SCHOOLS IS NOT THE PARENT'

Post on party’s Facebook page echoes view of

former Virginia Governor

By Tom Gantert, January 17, 2022

Editor's note: After

this story was published, the Michigan Democratic Party retracted the post and

issued this statement:

Editor's note: After

this story was published, the Michigan Democratic Party retracted the post and

issued this statement:

“We have deleted a post that ignored the important role parents play—and should

play—in Michigan public schools. Parents need to have a say in their children’s

education, end of story. The post does not reflect the views of Michigan

Democrats and should not be misinterpreted as a statement of support from our

elected officials or candidates.”

The Michigan Democratic Party posted a meme on its Facebook page Saturday,

questioning whether parents who send their children to public schools have any

right to control what is taught there.

“Not sure where this

‘parents-should-control-what-is-taught-in-schools-because-they-are-our-kids’ is

originating, but parents do have the option to choose to send their kids to a

hand-selected private school at their own expense if this is what they desire,”

read the post (emphasis in the original).

The post appeared on what is called “The Official Facebook Page of the Michigan

Democratic Party.” The page states it is under the control of the Michigan

Democratic State Central Committee.

The message continued: “The purpose of a public education in a public schools is

not to teach kids only what parents want them to be taught. It is to teach them

what society needs them to know. The client of the public schools is not the

parent, but the entire community, the public” (emphasis in the original).

Michigan law contains language suggesting something different, however, which

was pointed out in a user comment posted on the same Facebook page. Stephanie

Buikema, an employee of Rockford Public Schools, cited Section 380.10 of the

Michigan Revised School Code. It states:

“It is the natural, fundamental right of parents and legal guardians to

determine and direct the care, teaching, and education of their children. The

public schools of this state serve the needs of the pupils by cooperating with

the pupil’s parents and legal guardians to develop the pupil’s intellectual

capabilities and vocational skills in a safe and positive manner.”

“Michigan Democratic Party,” Buikema wrote, “you should familiarize yourselves

with the document.”

The Michigan Democratic Party’s Facebook post has similarities to the statement

made by former Virginia Democratic Gov. Terry McAuliffe, who was running for a

second nonconsecutive term in 2021. In a campaign debate, he made comments about

schools that many political insiders say cost him the election.

“I don’t think parents should be telling schools what they should teach,”

McAuliffe said. Republican Glenn Youngkin won the election.

Michigan Capitol Confidential is the news source produced by the Mackinac

Center for Public Policy. Michigan Capitol Confidential reports with a

free-market news perspective.

WHY THE STATE SHOULD

STOP SUBSIDIZING SELECT BUSINESSES

Corporate

handouts are unfair, ineffective and expensive

By James M. Hohman, June 30, 2021

Michigan’s business subsidies are unfair,

ineffective and expensive. Lawmakers should stop spending taxpayer dollars on

them.

They are unfair because they reward some businesses at others’ expense. The new

apartment complex in town gets a favor, while the old ones paying their share of

taxes do not. One auto supplier gets money while another doesn’t. They’re all

paying taxes, but some collect tax dollars, too, and state policymakers should

not be picking winners and losers like this.

Select subsidies are ineffective because they don’t do the job that lawmakers

created them to do: They don’t drive economic growth. They don’t help their

state add more jobs than others. A close look at the programs by economists

finds that they are a drain on growth rather than a cause of it. They can give

examples that look like state policymakers are doing something about jobs, but

they do not accomplish the objective they were created to achieve.

And they cost a lot of money that could be spent better elsewhere or used to

lower the state’s tax burdens. Michigan lawmakers will transfer $741.7 million

from taxpayers this year to the individual companies fortunate enough to get

state subsidies. That’s more than the state spends on environmental protection

and the Department of Natural Resources. And enough to cut the income tax rate

down to 3.95% without touching other state spending. Across the country, states

spend nearly twice as much on business subsidies as they do on fire protection.

Yet even reluctant lawmakers see that other states offer special deals to select

companies and think that they need to do so as well. That these other states

offer business subsidies is evidence enough for many lawmakers that their state

must have similar programs, too. Which is why, if states are going to continue

to offer business subsidies to compete with what other states provide, lawmakers

ought to sign on to an interstate compact to end the programs. States should not

compete based on unfair and ineffective tax favors, and they can agree to stop

together. Legislation to stop handing out new deals has been introduced in 15

states already, Michigan included.

Lawmakers ought to be skeptical of these programs and end them even if they

don’t want to sign on to an interstate compact. People of all political

persuasions ought to be uncomfortable with taking money from taxpayers and

handing it out to select businesses. These corporate handouts fail to grow the

economy, provide unfair advantages in the competition among firms and cost

taxpayers too much.

Permission to reprint this blog post in whole or in part is hereby granted,

provided that the author (or authors) and the Mackinac Center for Public Policy

are properly cited.

GRANHOLM GREEN ENERGY HANDOUT:

A GLOWING PROMISE AND CATTLE FEED

After getting millions from taxpayers, Alpena

biogas refinery now makes a livestock ingredient

By Jamie A. Hope, June 1, 2021

At its

launch in 2009, an operation called the Alpena Prototype Biorefinery was lauded

by Gov. Jennifer Granholm, the federal government and managers in the corporate

welfare arm of Michigan’s state government as the future of green energy.

At its

launch in 2009, an operation called the Alpena Prototype Biorefinery was lauded

by Gov. Jennifer Granholm, the federal government and managers in the corporate

welfare arm of Michigan’s state government as the future of green energy.

The plant still existed as of February 2021, according to various reports, but

it appears nowhere close to helping Michigan become, in Granholm’s words, “the

alternative energy capital of the world.”

The plant has received millions of dollars in taxpayer subsidies to produce

energy from nonconventional sources. But it is instead making wood molasses to

feed livestock, according to the latest reports in 2021.

Understanding how a project born amid promises of a becoming an energy source

became a producer of an obscure agricultural product is not easy task.

Sporadic reports in local news media indicate the original company was sold to

new owners. And according to The Alpena News, the city is seeking back taxes

owed by the original owner, called American Process Inc. The company also

defaulted on a subsidy deal with the Michigan Economic Development Corporation,

the state’s corporate welfare arm.

One media report says that 33 jobs were created with the taxpayer grants, but by

2015, the company suspended operations and quit producing ethanol. The plant

reopened in March 2016 and began producing wood molasses. The company breached

its agreement with the state when it stopped producing ethanol, according to The

Alpena News, and thus lost its tax-exemption deal with the MEDC.

The local newspaper also reported that the Alpena refinery was bought by GranBio,

a Brazilian company. As of February 2021, the city of Alpena was still pursuing

over $800,000 in back taxes from the current and previous owners, going back to

2016.

Alpena City Manager Rachel Smolinski did not return an email asking about the

status of the biorefinery.

The Alpena biorefinery is not the only Michigan renewable energy scheme to be

launched on a wave of promises and publicity and then sink out of sight when the

promises went unfulfilled.

“We are continuing to diversify Michigan’s economy through the development of

green energy technologies,” Granholm said when announcing that the area around

the Alpena facility had been designated a tax-exempt Renewable Energy

Renaissance Zone. The designation allowed the company “to operate free of

virtually all state and local taxes for 15 years,” according to the MEDC.

Companies that receive the designation often received multiple subsidies, and

this project was no exception.

American Process, Inc., original owner of the refinery, was awarded $4 million

by the Michigan Economic Development Corporation in 2009, and $22 million by the

U.S. Department of Energy under the Obama administration stimulus program.

“This grant, in support of one of our Centers of Energy Excellence, will bring

160 jobs to the Alpena area and strengthen Michigan’s efforts to be a leader in

the development of the next generation of biofuels,” Granholm said in 2009.

Greg Main, president and CEO of MEDC, also stated in 2009, “Developing and

harnessing green energy sources in Michigan is critical to securing a strong

economic future.”

When Granholm attended a ribbon cutting ceremony at the plant, she said, “We are

here today celebrating that Alpena has become a center for clean energy

excellence. This plant is not just good for Alpena, it is good because it

provides great hope for the great future of waste-to-energy.”

The U.S. Department of Energy also touted the promises in a statement that read,

“In the future, the Alpena Biorefinery may also be hired by other innovators to

evaluate emerging conversion technologies for the growing U.S. bioindustry.” The

department has not updated information on its website to reflect on the

company’s current activities in producing a cattle feed input.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective. From the Mackinac Center for Public Policy, a research and educational institute headquartered in Midland, Michigan. Permission to reprint in whole or in part is hereby granted, provided that the author and the Mackinac Center are properly cited.

WIND,

SOLAR FIRMS PICKED FOR GRANHOLM'S GOVERNOR MANSION SOON WENT BROKE

Detroit Free Press

reported the installation meant she’s not kidding on renewables

By Tom Gantert, May 10, 2021

A July 11, 2009, story in the

Detroit Free Press described then-Gov. Jennifer Granholm’s renewable energy

efforts.

A July 11, 2009, story in the

Detroit Free Press described then-Gov. Jennifer Granholm’s renewable energy

efforts.

“When Gov. Jennifer Granholm boasts that Michigan should be the renewable energy

capital of the nation, she’s not kidding,” the article stated.

“To prove her point, Granholm had a Michigan-made wind turbine installed at the

official residence in Lansing, and it started producing energy last week.”

The 1.2 kilowatt-per-hour turbine was made in Manistee by Mariah Power.

The 2009 article also reported that Granholm planned to install solar panels

made by United Solar Ovonic on the roof of the gubernatorial residence within

the next few months.

Mariah Power later became Windspire Energy. Both it and United Solar Ovonic

filed for bankruptcy in 2012, only three years later.

Both companies were subsidized through state tax credits delivered under the

Michigan Economic Development Corporation. United Solar Ovonic was awarded a

$17.3 million tax credit in 2008. Mariah Power was awarded a $400,000 grant by

the MEDC in 2008.

From the Mackinac Center for Public Policy, a research and educational institute headquartered in Midland, Michigan. Permission to reprint in whole or in part is hereby granted, provided that the author and the Mackinac Center are properly cited.

MICHIGAN BUREAUCRATS WANT PERMANENT COVID REGULATIONS

Michigan workplace regulators propose

permanent rules for temporary problem

By Michael Van Beek, April 19, 2021

Gov. Gretchen Whitmer just

extended emergency COVID-19 rules that all Michigan employers must follow. Among

other things, they require businesses to conduct daily health screenings of

employees, require masks to be worn whenever anyone could be within six feet of

someone else and isolate employees who have a suspected case of COVID. Unless

rescinded, these rules will continue until October. But they could last even

longer, because the Michigan Occupational Safety and Health Administration wants

to transform these emergency rules into permanent ones.

Gov. Gretchen Whitmer just

extended emergency COVID-19 rules that all Michigan employers must follow. Among

other things, they require businesses to conduct daily health screenings of

employees, require masks to be worn whenever anyone could be within six feet of

someone else and isolate employees who have a suspected case of COVID. Unless

rescinded, these rules will continue until October. But they could last even

longer, because the Michigan Occupational Safety and Health Administration wants

to transform these emergency rules into permanent ones.

In the department’s filings, required by state law to create new administrative

rules, MIOSHA admits that only one other state in the country has created

permanent COVID-19 regulations like these — Virginia. But the Virginia rules

MIOSHA references are labeled “emergency temporary standards,” so it is not

clear that this is the case. Either way, Michigan is one of the first states

where unelected bureaucrats are seeking permanent COVID regulations on

businesses.

The department says in its filings with the state’s Office of Administrative

Hearings and Rules that these regulations are needed because “Michigan’s

experience with COVID-19 demonstrates that the disease can spread rapidly

without protective measures and standards in place.” But that rationale doesn’t

hold much water, considering identical emergency rules have been in place since

last October, and Michigan has experienced two separate COVID-19 waves since

then.

Regardless of whether the state should impose permanent regulations in response to a temporary emergency, the proposed rules raise concerns for several other reasons. Here are some of them:

They do not automatically expire when the COVID-19 pandemic is over. Even after the state health department rescinds its “epidemic orders” and no other emergency declarations are active, these rules can stay on the books. They only require state bureaucrats to “examine the continued need for these COVID-19 rules” after the state’s other emergency controls are lifted.

The rules do not mention the word “vaccine” and could remain in place regardless of how many people are vaccinated. This means that employers would still have to require their employees to wear masks, work from home and socially distance even if the entire workplace is fully vaccinated.

Some of the proposed rules originate from mandates issued by Gov. Whitmer through executive orders last spring and are based on an outdated understanding of the coronavirus. For instance, they prohibit employees from sharing equipment and require employers to “increase facility cleaning and disinfection.” That’s because last spring it was thought that virus could easily spread on surfaces. That’s no longer supported by the science, and the Centers for Disease Control and Prevention recently estimated that the chance of catching COVID from surface contact is one in 10,000.

Some mandates are ill-defined and poorly written, making it difficult for employers to know if they are complying. For example, they require businesses to “create a policy promoting remote work for employees to the extent that their work activities can feasibly be completed remotely.” But what counts as “feasible” or “promoting” is not defined, so employers will have to make a guess of it.

The rules turn businesses into mask police; it mandates that they require customers to wear face coverings. Current epidemic orders — mandates from the state health department distinct from MIOSHA rules — obligate everyone two and older to wear masks in public. But even after those orders are lifted, these rules would obligate employers to force customers to mask up nevertheless. Businesses will be stuck between turning away customers who don’t want to wear masks (even fully vaccinated ones) or risk state penalties.

As part of the rulemaking process,

the department must submit a form called a “regulatory impact statement and

cost-benefit analysis,” which requires it to consider the compliance costs these

rules will impose on Michigan businesses. Amazingly, and somewhat

disingenuously, MIOSHA claims these rules will impose “no additional burdens.”

Its reasoning is that identical mandates are already in place, so businesses

won’t face any new costs if these rules are made permanent. That’s akin to

knocking a guy to the ground and then claiming that pinning him there won’t do

him any harm because he’s already lying down.

Given an inch, MIOSHA stands poised to take a mile. Unfortunately, this has been

the typical approach by the Whitmer administration, perhaps the only consistent

aspect of her COVID-19 strategy.

Permission to reprint this blog post in whole or in part is hereby granted, provided that the author (or authors) and the Mackinac Center for Public Policy are properly cited.

CITING THE

AMERICAN REVOLUTION . . . BARAGA COUNTY OFFICIALS REVOLT AGAINST STATE COVID

ORDERS

Upper Peninsula community’s leaders point to their oath

By Tom Gantert,| January 12, 2021

Several Baraga County commissioners, plus the sheriff, prosecuting attorney,

clerk, and treasurer of the Upper Peninsula county, have all signed a manifesto

that places the state on notice that they will no longer enforce the state's

COVID-19 mandates and restrictions.

Several Baraga County commissioners, plus the sheriff, prosecuting attorney,

clerk, and treasurer of the Upper Peninsula county, have all signed a manifesto

that places the state on notice that they will no longer enforce the state's

COVID-19 mandates and restrictions.

The declaration reads: “Since March 10, 2020, the People of the State of

Michigan have endured restrictions on their freedom which have not been seen in

North America since the days of King George III and the American Revolution. In

the face of a worldwide pandemic our political leadership in Lansing has ignored

the protections guaranteed to all America citizens by the Bill of Rights in

favor of the medical models designed to predict the course of a still, for the

most part, unknown virus. The result has been the unilateral adoption of clearly

unconstitutional measures which treat human beings like herd animals and which

arbitrarily pick economic winners and losers. Our citizens’ rights to assemble,

to freely practice their religion, to travel, to keep their property, businesses

and jobs, even to dress as they please have all been swept aside, and to what

end? The pandemic rages on and Lansing’s failed efforts to control the spread of

the virus is blamed on the people themselves rather than the scientific

community’s admitted lack of data and understanding of COVID-19.”

The manifesto continued: “Enough is enough. We have taken an oath to uphold and

defend the Constitution of the United States of America, an oath we take very

seriously. Accordingly, we hereby put the State of Michigan on NOTICE that we

have no intention of participating in the unconstitutional destruction of our

citizens’ economic security and Liberty. We further declare our intention to

take no action whatsoever in furtherance of this terribly misguided agenda.

Finally, we call upon the Michigan Legislature to exercise their co-equal

authority by adopting constitutionally sound measures which limit the unchecked

exercise of executive power, which restore individual responsibility and

accountability, and which return Michigan to the ranks of freedom-loving

governments everywhere.”

The Baraga County elected officials who signed the declaration include Sheriff

Joe Brogan, Clerk Wendy Goodreau, Treasurer Jill Tollefson, Prosecuting Attorney

Joseph O’Leary and Commissioners Gale Eilola, Dan Robillard, Will Wiggins,

William Rolof and Lyle Olsen.

Michigan Capitol Confidential is the news source produced by the Mackinac Center

for Public Policy. Michigan Capitol Confidential reports with a free-market news

perspective.

From the Mackinac Center for Public Policy,

a research and educational institute headquartered in Midland,

Michigan. Permission to reprint in whole or in part is hereby

granted, provided that the author and the Mackinac Center are

properly cited.

GOP STATE LEGISLATURES:

COWARDICE UNDER FIRE

Republican lawmakers in the

battleground states surrender without a fight.

By David Catron, December 7, 2020

Despite

the mendacious claims of the legacy “news” media, there is clear evidence that

egregious violence was done to election laws in at least five states during the

recent presidential contest. Sworn testimony from dozens of eyewitnesses,

well-documented breaches of statutory ballot counting protocol, and damning

security camera videos have been presented to legislators in these states.

Republican lawmakers in Arizona, Georgia, Pennsylvania, Michigan, and Wisconsin

have the constitutional power and the moral duty to rectify the resultant

fraudulent outcomes. The only obstacle to reestablishing voter sovereignty in

these five states is the inaction of the spineless GOP majorities that control

their legislatures.

Despite

the mendacious claims of the legacy “news” media, there is clear evidence that

egregious violence was done to election laws in at least five states during the

recent presidential contest. Sworn testimony from dozens of eyewitnesses,

well-documented breaches of statutory ballot counting protocol, and damning

security camera videos have been presented to legislators in these states.

Republican lawmakers in Arizona, Georgia, Pennsylvania, Michigan, and Wisconsin

have the constitutional power and the moral duty to rectify the resultant

fraudulent outcomes. The only obstacle to reestablishing voter sovereignty in

these five states is the inaction of the spineless GOP majorities that control

their legislatures.

As I and others have previously noted, the Constitution reserves the sole power

to select presidential electors and the method by which they are chosen to the

state legislatures: “Each State shall appoint, in such Manner as the Legislature

thereof may direct, a Number of Electors, equal to the whole Number of Senators

and Representatives to which the State may be entitled in the Congress.” No

other state official or judge can make this call without legislative consent.

The pathetic excuses of the lawmakers themselves notwithstanding, they can

restore election integrity in their states. Instead, they take positions similar

to the “leaders” of the Michigan legislature, who offered this pusillanimous

statement:

The Senate and House Oversight Committees are actively engaged in a thorough

review of Michigan’s elections process and we have faith in the committee

process to provide greater transparency and accountability to our citizens. We

have not yet been made aware of any information that would change the outcome of

the election in Michigan and as legislative leaders, we will follow the law and

follow the normal process regarding Michigan’s electors, just as we have said

throughout this election.

They are evidently “not aware” of clear violations of state law by Michigan

Secretary of State Jocelyn Benson, who illegally gave private activist

organizations access to voter rolls. Among the recipients of Benson’s disregard

for this statute was the Center for Tech and Civic Life (CTCL), an organization

controlled by Facebook founder Mark Zuckerberg. They also failed to notice that

Zuckerberg’s organization donated $350 million that paid for “election workers”

whose activities were largely carried out in the very counties in which election

canvassers at first refused to certify the election results due to serious

irregularities. At length the latter acquiesced after being physically

threatened, accused of racism, and doxxed.

The Amistad Project has filed a lawsuit with the Michigan Supreme Court asking

the judges to direct the state legislature to conduct an investigation into the

above-described violations as well as many others. As the director of the

Amistad Project phrased it, “The pattern of lawlessness was so pervasive and

widespread that it deprived the people of Michigan of a free and fair election,

throwing the integrity of the entire process into question.” This lawsuit

wouldn’t be necessary, of course, if the GOP legislature showed any inclination

to conduct a serious inquiry. Unfortunately, their inertia is all too typical,

as the following statement by the Republican Speaker of the Arizona House of

Representatives makes clear:

Rudy Giuliani, Jenna Ellis, and others representing President Donald Trump came

to Arizona with a breathtaking request: that the Arizona Legislature overturn

the certified results of last month’s election and deliver the state’s electoral

college votes to President Trump…. Giuliani and Ellis made their case during a

closed-door meeting at the State Capitol with Republican leaders from both

chambers of the Legislature … the Trump team made claims that the election was

tainted by fraud but presented only theories, not proof.

This claim will immediately be recognized by anyone who watched Arizona’s

November 30 public hearings as an evasion of their constitutional oath and a

betrayal of the numerous election workers who gave eyewitness testimony to

Arizona legislators. Moreover, the closed-door meeting mentioned above almost

certainly included information that was too sensitive to be revealed in public.

Yet the GOP leadership of the Arizona legislature merely parrots the Democrat

Party line promulgated in the media — that there was no proof. To mollify the

angry GOP voters who helped them maintain the undeserved legislative majority,

they will conduct a superficial audit of ballot counting and voting machines in

Maricopa County.

Meanwhile, as the major lawsuit rendered inevitable by the transparent election

skullduggery that occurred in Pennsylvania escapes the Democrat-controlled court

system and awaits a ruling by the U.S. Supreme Court, the Keystone State’s

legislators are showing some signs of life. A group of 64 Pennsylvania

Republican lawmakers have signed a letter asking their congressional

representatives not to certify the commonwealth’s electoral votes for Joe Biden.

The seven-page letter lays out several instances in which the state’s Democrat

Gov. Tom Wolf and various election officials “set about undermining the many

protections” provided by a bipartisan election law passed three years ago,

including the following:

The Pennsylvania Election Code requires that all mail-in ballots be received by

8 p.m. on Election Day; Governor Wolf ordered that this statutory deadline be

waived.… The Pennsylvania Election Code prohibits counties from inspecting

ballots prior to 7 a.m. on Election Day; Pennsylvania’s Secretary of State

issued guidance encouraging counties to ignore this prohibition … The

Pennsylvania Election Code prohibits the counting of defective absentee or

mail-in ballots; the Department of State and some county boards of elections

ignored this prohibition.

In the Supreme Court, Justice Samuel Alito is awaiting Pennsylvania’s response

to the Trump administration’s petition pursuant to these violations, and Alito

moved the deadline for their answer to the December 8 safe harbor date, when all

election disputes in the states are to have been resolved. Regardless of what is

decided in that case, Pennsylvania’s 20 votes are not enough to flip the

election. Moreover, despite Georgia Gov. Brian Kemp’s refusal to call a joint

session of the legislature to consider the state’s electoral votes, new

testimony seen by legislators increases the possibility that representatives of

the Peach State may visit SCOTUS. On Sunday, Attorney Alan Dershowitz raised the

issue: